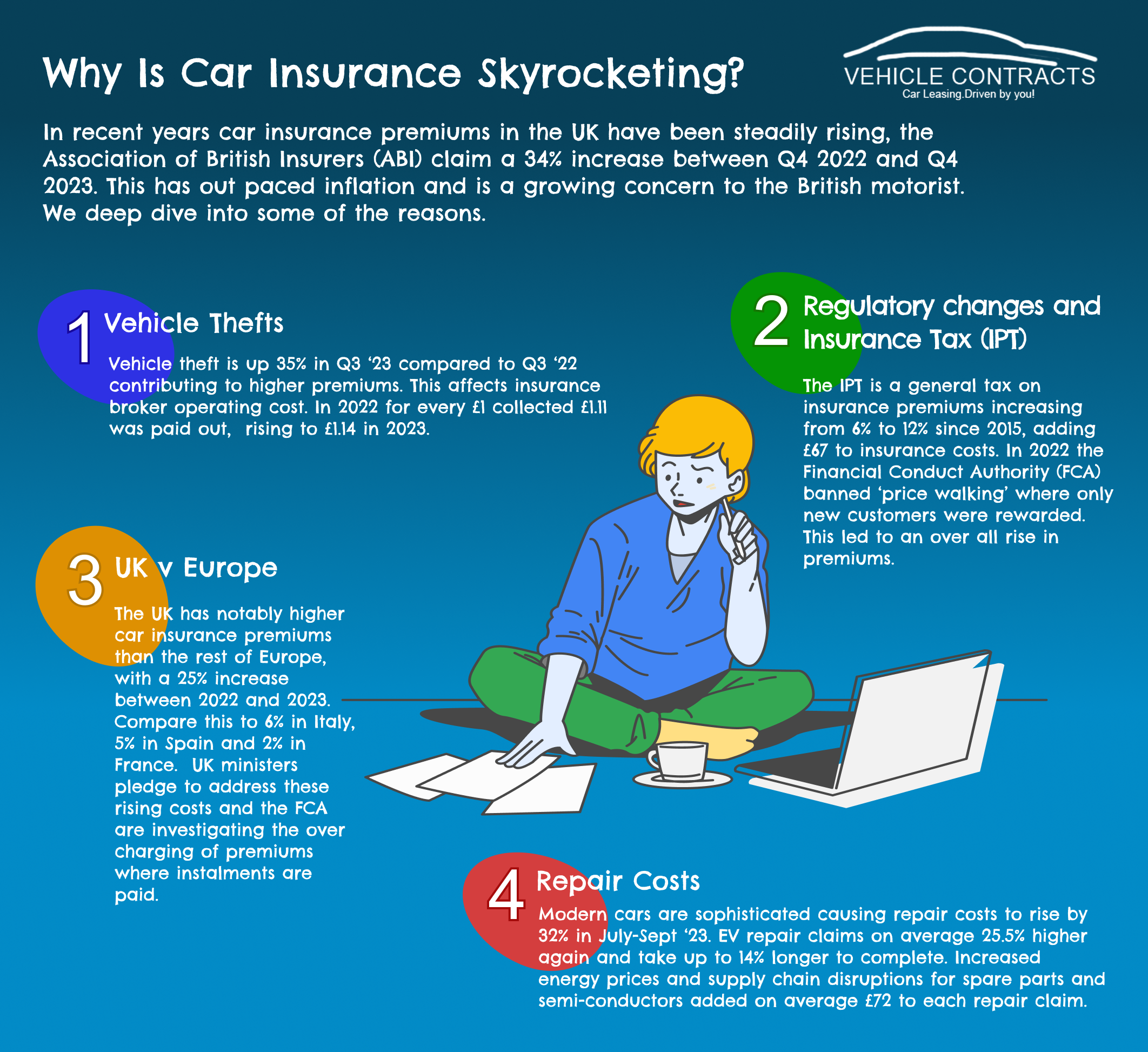

In recent years, car insurance premiums in the UK have been steadily rising, much to the displeasure of the British insurance buyer. The Association of British Insurers (ABI) claim there has been a massive 34% increase between Q4 2022 and Q4 2023. This percentage has out paced inflation and is a growing concern to motorists. Here at Vehicle Contracts, we decided to take a closer look as to what factors are contributing to these risers.

Modern cars are getting more sophisticated, and they require a more specialist car mechanic to repair them. This caused an increase in repair costs by 32% in July-Sept ‘23. As well as higher costs, it also means that there are longer delays in repairs being undertaken as dealer garages have to cope with the backlog. EV repair claims need a different type of specialist equipment to compete the repair, which usually means a higher cost. On average, EV repairs are 25.5% higher again and can take up to 14% longer to complete. Other factors contributing to the rising costs, are increased energy prices and supply chain disruptions for spare parts and semi-conductors during and post pandemic. This has added on average £72 to each repair claim.

Thieves are a contributing factor to the increases in premiums. Vehicle theft was up 35% in Q3 ‘23 compared to Q3 ‘22. This also affect the insurance brokers who, at one point, weren’t even making a profit when for every £1 collected in 2022 they paid out £1.11 in claims and that rose to £1.14 in 2023.

The Insurance Premium Tax (IPT) is a general tax on insurance premiums and has increased since 2015 from 6% to 12%, adding an average £67 to insurance costs. In 2022 the Financial Conduct Authority (FCA) banned ‘price walking’ where new customers were rewarded and given better deals, instead saying that customer loyalty should be rewarded. This has led to an increase in new customer quotes being issued and over all a rise in premiums,

The UK has notably higher car insurance premiums than the rest of Europe, with a 25% increase between 2022 and 2023. Europe’s premiums haven’t rocketed like the UK, Italy saw a 6% increase, Spain 5% and France only 2% much to the British insurance buying public. UK ministers pledge to address the rising costs and FCA are also investigating that those choosing to pay a monthly premium might also be being overcharged, contributing to the ever-increasing rising premium costs.

However, it’s not all bad news, recent data shows that last year's premiums actually decreased by 16% from the previous year, so maybe the measures that are being put in place might be slowly taking effect, however even with this decrease, the average premium is still £834 higher a year.